Forex trading is an exciting financial market where participants buy and sell currencies, aiming to make a profit. To succeed in forex trading, it is essential to have the right knowledge and skills, but there are also some secret settings that can give you an edge. In this article, we will dive into these secret settings and explore how they can enhance your trading performance.

Credit: www.amazon.com

The Importance of Secret Settings

Secret settings in forex trading are specific configurations that traders use on their trading platforms to enhance their decision-making process and improve overall performance. These settings are not widely known, and only experienced traders have discovered their effectiveness through trial and error.

By understanding and implementing these secret settings, you can gain an advantage over other traders and potentially increase your profitability in the forex market.

The Fibonacci Indicator

One of the most popular secret settings in forex trading is based on the Fibonacci indicator. This mathematical sequence is widely used by traders to identify potential support and resistance levels in the currency market. The Fibonacci levels act as guidelines for placing stop-loss and take-profit orders.

| Fibonacci Level | Percentage |

|---|---|

| 0.236 | 23.6% |

| 0.382 | 38.2% |

| 0.500 | 50% |

| 0.618 | 61.8% |

| 0.786 | 78.6% |

By using Fibonacci levels, traders can identify potential entry and exit points, as well as appropriate levels for setting stop-loss orders to protect against potential losses.

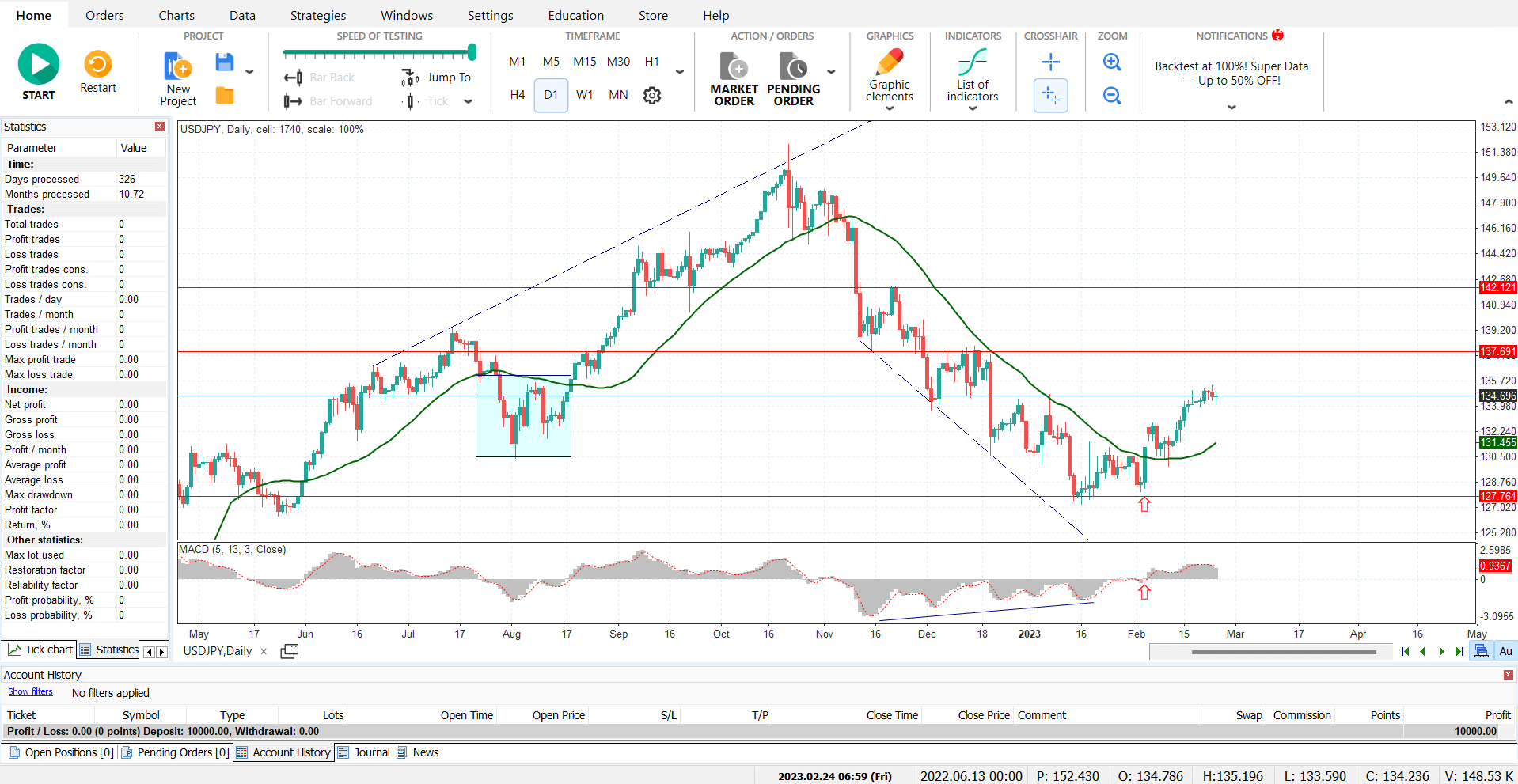

The Moving Average Crossover Strategy

Another secret setting that traders frequently utilize is the moving average crossover strategy. This strategy involves using two or more moving averages of different periods and identifying when they cross over one another. This crossover indicates a potential change in the market trend.

For instance, if a shorter-term moving average (such as the 50-day moving average) crosses above a longer-term moving average (such as the 200-day moving average), it is often seen as a bullish signal. On the other hand, if the shorter-term moving average crosses below the longer-term moving average, it may be interpreted as a bearish signal.

Credit: forextester.com

Reversal Candlestick Patterns

Candlestick patterns provide valuable insights into the psychology of the market and can influence a trader’s decision-making process. Reversal candlestick patterns, in particular, indicate potential trend reversals and can be powerful secret settings for forex traders.

Some common reversal candlestick patterns include:

- Doji

- Engulfing patterns

- Hammers

- Shooting stars

By being able to identify these patterns, traders can anticipate potential market reversals and adjust their trading strategies accordingly.

The Power of Risk Management

While secret settings can enhance trading performance, it is crucial not to overlook risk management. Proper risk management techniques are essential for long-term success in forex trading.

Some key risk management tips include:

- Setting appropriate stop-loss orders to limit potential losses

- Using proper position sizing to manage risk exposure

- Diversifying your trading portfolio to spread risk

- Maintaining a disciplined approach to trading and avoiding emotional decision-making

Frequently Asked Questions Of Forex Trading Secret Setting: Master The Powerful Techniques

What Are The Secret Settings For Successful Forex Trading?

Successful forex trading requires setting realistic goals, using risk management techniques, and staying disciplined in executing trades.

How Can I Improve My Forex Trading Strategy?

To improve your forex trading strategy, focus on back testing, analyzing market patterns, staying updated with global news, and learning from experienced traders.

What Are The Best Indicators For Forex Trading?

The best indicators for forex trading depend on your trading style, but popular ones are moving averages, RSI, MACD, and Bollinger Bands.

How Important Is Risk Management In Forex Trading?

Risk management is crucial in forex trading as it helps protect your capital and minimizes losses by setting stop-loss orders and using appropriate position sizing.

Conclusion

Incorporating secret settings into your forex trading strategy can provide you with a significant advantage in the market. The Fibonacci indicator, moving average crossover strategy, reversal candlestick patterns, and effective risk management techniques are just a few examples of the secret settings that experienced traders employ.

However, it is important to note that these secret settings should be used in conjunction with proper knowledge and skills in forex trading. Continuous learning, practice, and understanding market dynamics play a vital role in achieving success as a forex trader.

Take the time to explore and experiment with these secret settings, but always remember to analyze and verify their effectiveness before fully implementing them into your trading strategy. With dedication and persistence, you can unlock the hidden potential of these secret settings and elevate your forex trading game.