Are you looking for car insurance in Austin, Texas? Buying car insurance online is a convenient and cost-effective option. With no agent fees or markups, it offers the cheapest rates. However, if you need guidance in selecting the best coverage, an agent can assist you throughout the purchase process.

Why Buy Car Insurance Online?

Buying car insurance online comes with several advantages:

- Convenience: You can compare different insurance companies and policies from the comfort of your own home.

- Cost Savings: Online policies often have lower premiums as there are no agent fees or markups.

- Easy Comparisons: You can easily compare insurance quotes and coverage options to find the best deal for your needs.

Credit: www.usatoday.com

Who Offers Online Car Insurance Quotes?

Many insurance companies offer online car insurance quotes, including:

- Progressive

- USAA

- Nationwide Mutual Insurance

- Safe Auto Insurance Company

- National General Insurance

If you prefer stability and good customer ratings, State Farm is a national insurer with the best cheap full-coverage car insurance. While Geico offers the lowest rates, State Farm provides better customer satisfaction and coverage overall.

What Type of Insurance is Cheapest?

When it comes to car insurance, fully comprehensive coverage is usually the cheapest option. It offers the most coverage out of the three policy types while still being affordable. However, the cheapest type of car insurance for you depends on your personal circumstances, such as age, occupation, and the type of car you drive.

Texas Car Insurance: Find the Best Deals Online

If you’re looking for cheap auto insurance in Texas, take advantage of online platforms to get the best rates:

- Liberty Mutual: Get a quote online for Texas car insurance.

- Mercury Insurance: Start your free quote online and save money.

- Nationwide: Get a free, customized auto insurance quote online.

- Allstate: Find coverage options and discounts with just a few clicks.

- Geico: Choose Geico for car insurance and save time with their quick online quote process.

- State Farm: State Farm offers car insurance quotes to fit any budget, with a wide range of coverage options.

- Esurance: Start a fast, free auto insurance quote tailored to your needs.

By comparing quotes from these reputable insurers, you can find the best car insurance deal in Texas.

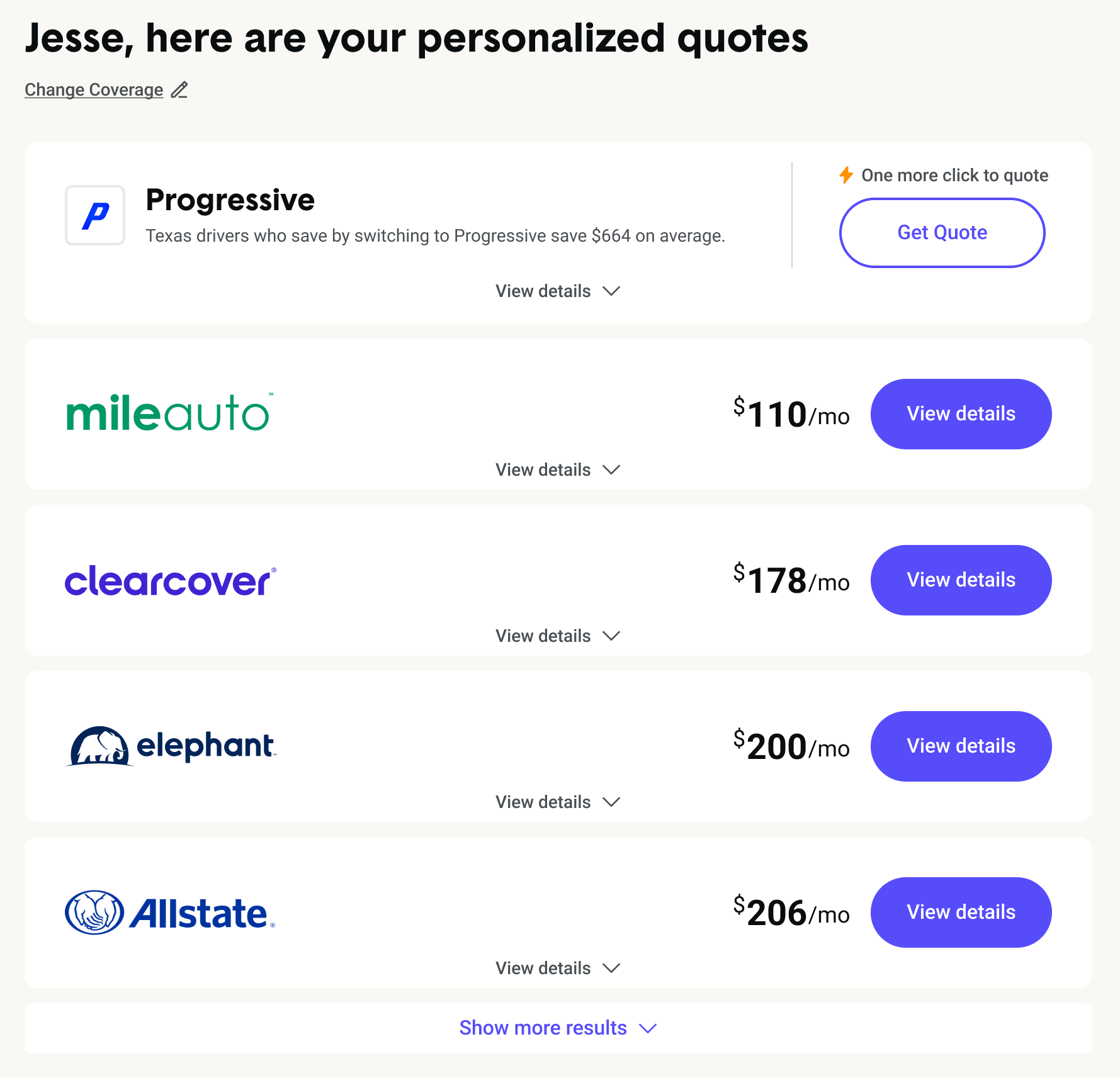

Credit: www.thezebra.com

Frequently Asked Questions On Car Insurance Online: Find Cheap Rates And Compare Quotations

Is It Ok To Buy Auto Insurance Online?

Yes, it is perfectly fine to buy auto insurance online. It is often cheaper as there are no agent fees or markups. However, if you need guidance in selecting the best coverage, an agent can assist you through the purchase process.

Who Normally Has The Cheapest Car Insurance?

State Farm and Geico are two insurance companies known for offering the cheapest car insurance rates. State Farm has the best customer ratings and coverage overall, while Geico offers the lowest rates.

Who Has The Cheapest Full Coverage Auto Insurance?

According to our research, State Farm is the national insurer that offers the cheapest full coverage auto insurance. While Geico has the lowest rates, State Farm has better customer ratings and overall coverage.

Which Type Of Insurance Is Cheapest?

Fully comprehensive cover is usually the cheapest type of car insurance, offering the most coverage. The cost will vary based on your personal circumstances such as age, occupation, and type of car.

Conclusion

Car insurance is a must-have for drivers, and buying insurance online offers many benefits. It is convenient, cost-effective, and allows for easy comparisons. While State Farm is the top choice for cheap full-coverage car insurance, Geico offers the lowest rates. However, the cheapest type of car insurance depends on your personal circumstances. Take advantage of online platforms, such as Liberty Mutual, Mercury Insurance, Nationwide, Allstate, Geico, State Farm, and Esurance, to find the best deals for car insurance in Texas.

ভালো অ্যাপ